maine tax rates for retirees

For deaths in 2021 the estate tax in Maine applies to taxable estates with a value over 587 million. There are certain complicated situations that apply such as for annuities.

Maine Income Tax Brackets 2020

And 12 on all remaining value.

. Taxes arent everything. State tax rates and rules for income sales property estate and other taxes that impact retirees. Now that they are collecting social security the tax calculation requires an extra step.

The rates of property and income taxes in maine tend to be on the higher side which can be challenging for some individuals. The tax treatment at the federal level of these retirement distributions is addressed in Pub 4491 Chapter 18 - Pension Income and on this site at Federal - Retirement Income. Includes taxable gifts from past two years.

800 451-9800 local. It has no sales tax no state income tax and no tax on social security. Income tax rates range from 335 3870064600 to 875 195450237950 Average property tax 1908 per 100000 of assessed value 2.

And as a plus for veterans all military pension income is tax-exempt. The median property tax in Maine is 193600 per year for a home worth the median value of 17750000. In addition you and your spouse may each deduct up to 10000 of pension income that is included in federal adjusted gross income.

Other low-tax states may have fewer programs that you might find helpful such as senior centers and public transportation. Payment Vouchers for the 2022 tax year. Maine tax rates for retirees.

Other states provide only partial exemption or credits and some tax all retirement income. Current year 2021 forms and tax rate schedules These are forms and tax rate schedules due in 2022 for income earned in 2021. With that being said the low cost of living may be less relevant depending on how much money you have for your retirement.

For state income taxes virginia doesnt tax social security. Maines income tax rate ranges from 58 to a top marginal rate of 715. That would add up to taxes of 1200 on that retirement account income taxes that you wouldnt have to pay in states like Alaska which has no income tax and Mississippi which exempts retirement account income.

Although the good news is that Maine does not tax Social Security Income. With all that in mind here are the top 10 best places to retire in Maine. The Maine Public Employee Retirement System MPERS serves the public with sound retirement services to Maine governments.

They also have higher than average property tax rates. Maine is ranked number twenty out of the fifty states in order of the average amount of property taxes. Retirement distributions need to be reviewed to ensure a proper reconciliation with Maine law occurs.

8 on first 3 million above the threshold. Maine with a tax burden of just over 10 is the ninth highest in the country. Ad Compare Your 2022 Tax Bracket vs.

Wages are taxed at normal rates and. Discover Helpful Information and Resources on Taxes From AARP. Military pensions are exempt.

Taxes on most retirement income. Oregon taxes most retirement income at the top rate while allowing a credit of up to 6250 for retirement distributions. 207 512-3100 PO.

Estates above that threshold are taxed as follows. Estate tax on estates over 425 million 16 rate. If the taxable income is.

Box 349 Augusta ME 04332. The additional amount is 3400 if the individual is both 65 or over and blind. See Maine Revenue for more.

Although the state does not tax Social Security income expect high tax rates of up to 715 on your other forms of retirement incomes. Some states with low or no income taxes have higher property or sales taxes. One of the downsides to living in Maine is the fact that the income tax and retirement income tax rate can be as high as 715.

Lets say your effective state tax rate in one of these states is 4 and your annual income from your 401k is 30000. The rates ranged from 0 to 795 for tax years beginning after December 31 2012 but before January 1 2016. Tax amount varies by county.

Employer Self Service login Call us toll free. Maine Revenue Services telephone assistance is available Monday through Friday between 900 am. Prior to January 1 2013 the graduated rates ranged from 2 to 85.

For deaths in 2020 the estate tax in maine applies to taxable estates with a value over 58 million. For questions on filing income tax withholding returns electronically email the Withholding Unit at withholdingtaxmainegov or call the Withholding line at 207-626-8475 select option 4. Some states exempt all pension income and most exempt Social Security benefits.

If you receive retirement income from a pension IRA or a 401k then you will be required to pay taxes as high as 715. And 400 pm excluding holidays. Compared to other states maine has relatively punitive tax rules for retirees.

For example while Illinois does not tax retirement income it has one of the highest sales and property taxes in the US. However Maines sales tax rate is considerably low at 55. 109 of home value.

10 on the next 3 million. Less than 33650 58 of Maine taxable income 33650 but less than 79750 1952 plus 675 of excess over 33650 79750 or. Kennebunk is a seaside town with a tax burden of 1570 which is the tax rate of every city on this list making that factor in the cost of living in Maineequal.

For tax years beginning on or after January 1 2016 the benefits received under a military retirement plan including survivor benefits are fully exempt from Maine income tax. The top rate income tax rate also went from 66 to 59 for 2021 and it drops again in 2022 to 55 and 2023 to 53. Counties in Maine collect an average of 109 of a propertys assesed fair market value as property tax per year.

Estate worth increases to 5 million in 2021. At one time or another pretty much everyone approaching retirement or early in retirement. Individuals may deduct 10000 of pension income although social security benefits received reduce that amount.

Maine doesnt tax social security benefits and retirees can deduct up to 10000 of eligible pension income. Your 2021 Tax Bracket to See Whats Been Adjusted. While it does not tax social security income other forms of retirement income are taxed at rates as high as 715.

Property taxes are also above average in Maine.

Report States With No Income Tax Get No Economic Boost Income Tax Income Charts And Graphs

The Best And Worst States For Retirement 2021 All 50 States Ranked Bankrate Clark Howard Retirement Life Map

Maine Retirement Tax Friendliness Smartasset

Which States Pay The Highest Taxes Business Tax Family Money Saving Economy Infographic

Maine Estate Tax Everything You Need To Know Smartasset

Maine Sales Tax Small Business Guide Truic

Top Ten De Paises Ideales Para Vivir Places To Go Retirement Planning Trip Planning

If You Want To Avoid Paying Lots Of Taxes You Might Want To Steer Clear Of The Northeast And Venture Towards Th Best Places To Retire Retirement Locations Map

Visualizing U S Stock Ownership Over Time 1965 2019 Investing Financial Wealth Chartered Financial Analyst

Maine Retirement Tax Friendliness Smartasset

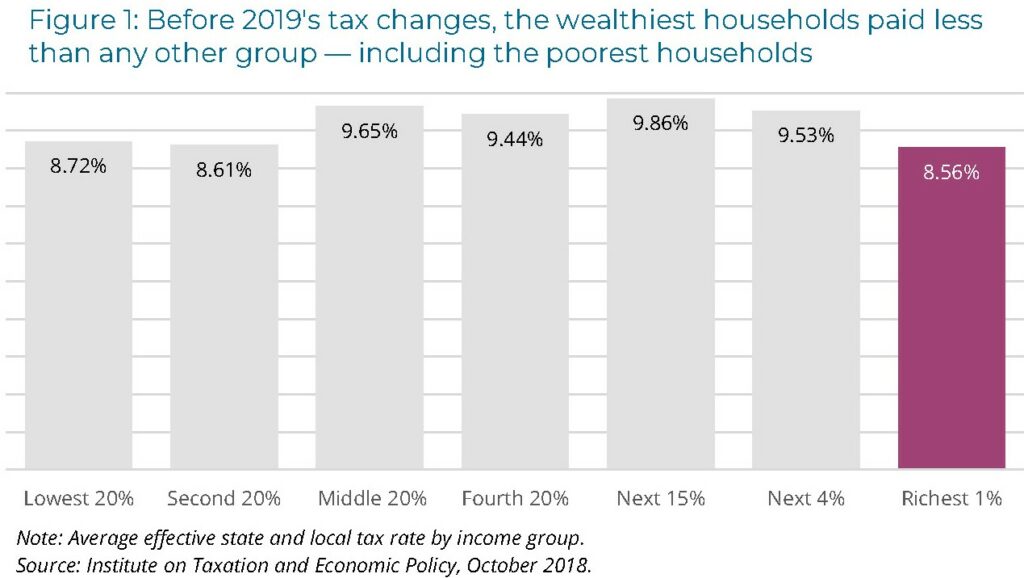

Maine Reaches Tax Fairness Milestone Itep

Maine Reaches Tax Fairness Milestone Itep

Tax Maps And Valuation Listings Maine Revenue Services

11 Pros And Cons Of Retiring In Maine 2020 Aging Greatly

Maine S Tax Burden Is One Of The Highest New Study Says Mainebiz Biz

Maine Retirement Tax Friendliness Smartasset

The 10 Best And Worst States For Military Retirees Retirement Retired Military Military Retirement